CEO Blog - Advice for CEOs on growth and scaling

A More Perfect Union: Four Keys to Credit Union Profitability

U.S. credit unions are in crisis.

For years, buoyed by a “hometown banking” distinction and bolstered by government regulations allowing for the expansion of their membership ranks, credit unions enjoyed unprecedented growth. In fact, just two years after President Clinton signed the 1998 Credit Union Membership Access Act, more than 10,000 credit unions dotted the landscape.

But then, the technological age arrived in its full fury, delivering tools and benefits that traditional banks used to restore their edge. Though credit unions enjoyed a higher level of customer satisfaction, they were not as keen to what their customers and members were needing. This allowed the traditional banks to use enhanced technologies to raise the customer expectations bar—and close the gap.

By the end of 2018, U.S. credit unions dwindled to less than 5,500, and profits (sometimes known as surplus funds in the nonprofit world of credit unions) dipped to a negative number for the first time ever.

For the survivors, improving efficiency became the preferred way to manage costs—but a singular focus on cost-cutting can ultimately, and irreparably, stymie growth.

So, how can credit unions, in the modern era, return to a posture of growth? And, more importantly, how can they use their hyper-local advantages to once again market for expansion?

I have spent a lot of time lately diving deep with credit unions, working to crack this code. In my view, there are four distinct steps that credit unions can follow to grow their bottom-line revenue:

1. Agree on how to grow. The most fundamental starting point is to understand what is considered “growth” at your credit union—is it number of members? Is it bottom line profitability? Is it the growth of particular products? When I explore this fundamental understanding with credit union clients, we find it to be a very clarifying conversation. Typically, we find that, in order to grow membership, credit unions need to be a healthy organization. And, for them to be healthy, it requires an improvement in profitability—which ultimately allows them to invest in things that will retain and grow membership.

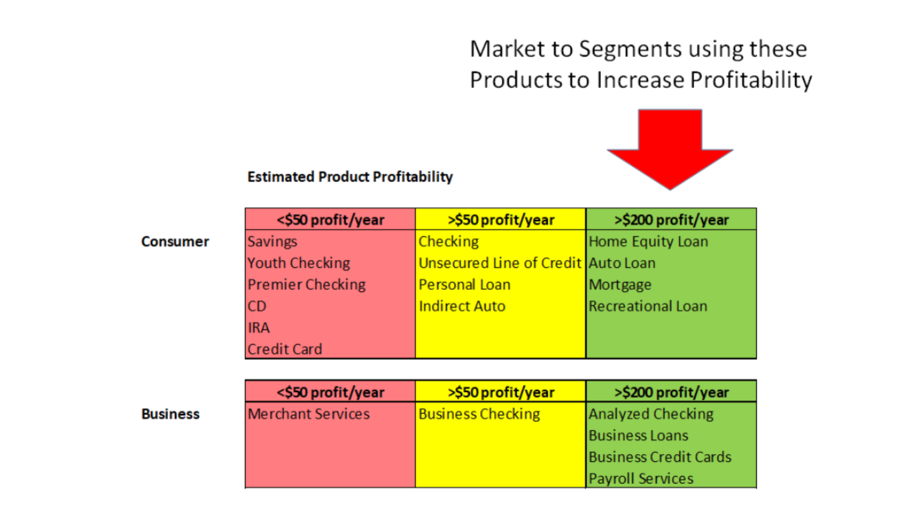

2. Understand what drives profitability. Some of the biggest aha moments come from the realization that not all products and services provide the same profitability lift. A grid of relative profitability—like the one pictured below (with the client’s name, of course, deleted for posterity), can quickly paint this picture in vivid detail. Zeroing in on the products that enjoy the twin benefits of being among the most profitable, as well as the most desirable to your members, can help you focus your marketing dollars more intelligently. 3. Segment your customer bases. With the intelligence gained in the first two steps, you can better understand on which type of customer will reap the greatest rewards for your bottom line. It’s at this stage when we begin to understand the marketing channels that will deliver the most bang for your buck. For younger depositors, it could be a social-media heavy campaign—ads on places like Instagram and YouTube. For others, it may be certain out-of-home options. Finding the right mix of channels, positioning and messaging is key to efficiently reaching your target customer segments.

3. Segment your customer bases. With the intelligence gained in the first two steps, you can better understand on which type of customer will reap the greatest rewards for your bottom line. It’s at this stage when we begin to understand the marketing channels that will deliver the most bang for your buck. For younger depositors, it could be a social-media heavy campaign—ads on places like Instagram and YouTube. For others, it may be certain out-of-home options. Finding the right mix of channels, positioning and messaging is key to efficiently reaching your target customer segments.

4. Track and analyze. Are you using the right tools to track what’s working? The key to replicating marketing successes lies in the ability to track it. If you truly want to quantify the benefit of your successful marketing campaigns, you must have insights at every step in the customer journey. This can be done with everything from statement inserts, to whether someone is using a mortgage calculator or tool on your website. Crunching this data will help you to determine whether your marketing efforts are having the right impact.

Finally, it’s important to understand that one size does not fit all. An experienced chief marketer, with experience in guiding this profit-restoration process, can be a true partner in helping you assess, analyze and implement real solutions for real growth. If I can be of any assistance to you and your leadership team, please feel free to reach out.

Topics: Business Growth Strategy, CEO Business Strategy, Financial Services

Thu, May 16, 2019Featured Chief Outsider

/CMO-Chris-Wallner.jpg?width=200&height=200&name=CMO-Chris-Wallner.jpg)

Chris Wallner

- Press Releases

- Careers

- Case Studies

- Marketing Consultant Company

- Marketing Strategy Consultants

- Marketing Plan Consultants

- B2B Marketing Consultants

- Virtual CMO

- Marketing Consultant Outsourcing

- Fractional CMO

- What is a Fractional CMO

- Healthcare Marketing Consultant

- Marketing Consultant Houston TX Texas

- Marketing Consultant Texas TX

- Marketing Consultant Bay Area

- CEO Blog

- Ebooks Plus

- Executive Marketing Consultants

- Product Marketing Consultants

- B2C Marketing Consultants

- Virtual Marketing Consultants

- Senior Marketing Consultants

- Temporary CMO

- Hire a CMO

- Fractional CMO Salary

- Fractional CMO Responsibilities

- Marketing Consultant Austin TX Texas

- Marketing Consultant Dallas TX Texas

- Marketing Consultant San Antonio

- Helping Private Equity

- Private Equity Blog

- Leadership Team

- Privacy Policy

- Business Marketing Consultants

- Strategic Marketing Consultants

- Marketing Technology Consultants

- Sales and Marketing Consultants

- CMO Job Description

- CMO Salary

- Fractional CMO Agency

- Fractional CMO Services

- CPG Marketing Consultant

- Marketing Consultant San Diego

- Partners

Houston, TX 77056

© 2023 Chief Outsiders